The best quant mashup links for the week ending Saturday, 11/14 as voted by our readers:

- Build Better Strategies! [Financial Hacker]

- A Filter Selection Method Inspired From Statistics [QuantStrat TradeR]

- Unsupervised candlestick classification for fun and profit – part 1 [Robot Wealth]

- Random data: Evaluating [Investment Idiocy]

- Correlation and correlation structure (3), estimate tail dependence using regression [Eran Raviv]

- The World’s Longest Trend-Following Backtest [Alpha Architect]

* * *

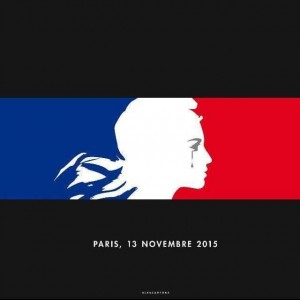

The prayers of everyone associated with Quantocracy go out to the people of France. I lack the eloquence to find words that could possibly begin to soften your pain, but please know that the world weeps for you, and stands united with you.

The prayers of everyone associated with Quantocracy go out to the people of France. I lack the eloquence to find words that could possibly begin to soften your pain, but please know that the world weeps for you, and stands united with you.

Vive la France!