The best quant mashup links for the two weeks ending Saturday, 07/09 as voted by our readers:

- Backtesting Based on Multiple Signals – Beware of Overfitting [Alpha Architect]

- Cloud-Based Automated Trading System with Machine Learning [Quant Insti]

- Alpha’s measurement problem [Flirting with Models]

- Can a simple Market Internals technique improve trading strategy results? [Better System Trader]

- Deciphering Correlation Hedged Momentum [TrendXplorer]

We also welcome one new blog making its first ever appearance on the mashup:

* * *

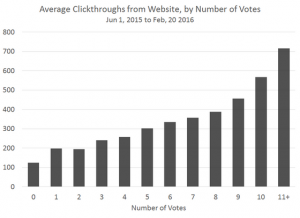

Your votes matter to the quant community.The graph to the right shows the average number of clickthroughs a link receives from our website (excluding RSS, Twitter and Stocktwits), broken out by the number of votes cast by our readers.

A core goal of Quantocracy is to have a positive impact on our corner of the financial world by rewarding the best work, and encouraging the best minds to keep writing.

As the graph makes clear, the citizens of Quantocracy are doing just that (way to go guys). Links with 11 or more votes receive nearly 6-times as many clickthroughs as a link with no votes (wow).

If you haven’t done so already, we invite you to register to vote and be a part of the effort. Your votes matter to the quant community.

Read on Readers!

Mike @ Quantocracy